Introduction

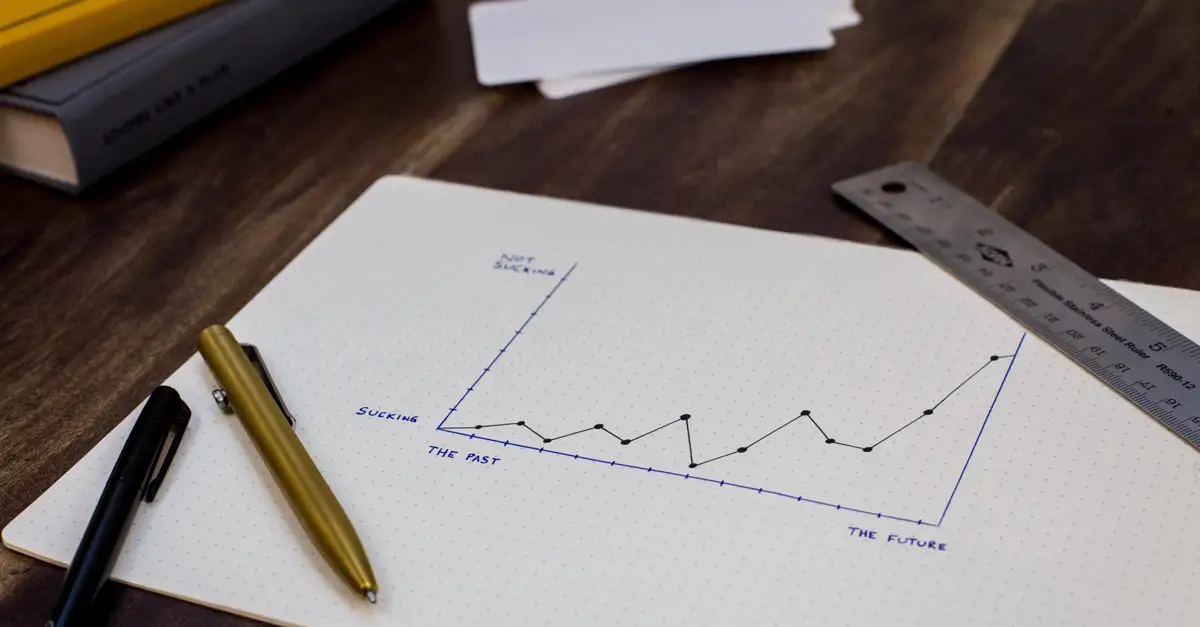

India’s insurance market is experiencing significant growth, fueled by economic expansion, a burgeoning middle class, innovation, and supportive regulations. Over the next five years (2024–2028), insurance premiums are projected to grow by 7.1% in real terms, outpacing global, emerging, and advanced market averages. This makes India’s insurance sector the fastest-growing among the G20 countries.

To capitalise on this growth, insurance companies are aggressively hiring new employees, particularly in smaller towns and cities where technological familiarity may be limited. Many of these new hires are just beginning to use the internet, primarily on mobile devices with slow connections, and often require support in their local languages. Consequently, HR leaders are prioritizing the recruitment of tech-savvy salespeople or providing training to enhance their technological proficiency.

Digital Transformation and Technological Integration

In today’s rapidly evolving world, the insurance industry is undergoing a significant transformation. The integration of advanced technologies and digital insurance platforms is revolutionizing how insurers operate, bringing about unprecedented changes and opportunities. Digital insurance platforms are becoming the norm, offering streamlined processes and enhanced customer experiences. The adoption of AI in the insurance industry is accelerating, providing more accurate risk assessments, personalized policies, and improved claims processing.

Technological integration is not just a trend but a necessity for survival and growth in the insurance sector. Digital transformation strategies are pivotal in enabling insurers to stay competitive. These strategies encompass a range of technologies, including AI and machine learning, which are essential for developing smarter, more efficient operations. Usage-based insurance (UBI) is one such innovation, allowing insurers to offer personalized premiums based on real-time data.

Workforce Expansion and Development

In addition to technological training, companies are emphasizing the development of soft skills. New employees are being trained to focus on customer needs, develop desirable products, and navigate a highly connected work environment. This holistic approach to employee development is essential in a competitive talent market, similar to those in IT/ITES, fintech, and e-commerce industries.

To attract and retain top talent, insurance companies are increasingly focusing on initiatives such as Diversity, Equity & Inclusion (DEI) and sustainability. These initiatives are important to both customers and employees and help to create a more appealing and supportive work environment. HR professionals in the insurance sector also face complex regulatory and compliance challenges. They must navigate constantly changing regulations, including those across multiple countries, as insurance firms expand their operations into new markets.

Addressing Attrition Rates

The workforce expansion in the insurance sector is notable. For example, Bajaj Allianz Life Insurance has grown its workforce from 7,000 to 23,000 employees over the past five years, with plans to hire an additional 3,000 employees and increase campus recruits to 1,500 this fiscal year. Similarly, ICICI Prudential Life Insurance has onboarded approximately 3,500 employees in the last three years, focusing on sales frontline sourcing roles and freshers.

High attrition rates within the sector have led companies to rely more on recruitment agents and implement new retention strategies. Bajaj Allianz Life Insurance, for instance, has extended notice periods to three months to deter sudden employee departures and emphasizes its referral program, with around 70% of hires coming through employee referrals. ICICI Prudential Life Insurance is also enhancing its capabilities in specialized functions and has introduced special incentive schemes to encourage employee referrals.

The digital transformation of the insurance industry is reshaping every aspect of the business, from customer interactions to internal operations. Embracing these changes is essential for staying relevant and competitive in the modern market. By leveraging innovative HR technologies, focusing on employee development, and addressing regulatory challenges, insurance companies can maintain a competitive edge and ensure a bright future for the sector.

The Rise of AI in the Insurance Industry

The insurance industry is experiencing a significant transformation with the rise of artificial intelligence (AI). AI in the insurance industry is not only revolutionising traditional processes but also reshaping the HR, hiring, and recruitment landscape. This section explores how AI is impacting these critical areas, driving efficiency, and enhancing the overall talent acquisition process.

AI is streamlining the recruitment and hiring processes in the insurance industry, making them more efficient and effective. By leveraging AI-powered tools, insurers can automate various stages of recruitment, from sourcing and screening candidates to conducting initial interviews. AI-driven recruitment platforms quickly analyse resumes, match candidates to job descriptions, and rank them based on their qualifications and experience. This not only saves time but also ensures that the best candidates are shortlisted for further evaluation.

AI enables insurers to source candidates from a broader pool, including passive job seekers. AI algorithms scan social media platforms, professional networks, and job boards to identify potential candidates who match the required skill set. Additionally, AI tools analyse large volumes of data to identify trends and patterns in candidate behavior, helping recruiters to target the right candidates with personalised job offers. This proactive approach to candidate sourcing increases the chances of finding top talent.

AI-driven screening tools are transforming how insurers evaluate candidates. These tools use natural language processing (NLP) and machine learning algorithms to assess resumes, cover letters, and application forms. They identify key skills, experiences, and qualifications, reducing the manual effort required in the initial screening process. Furthermore, AI-powered assessment platforms conduct automated interviews, analyse candidates’s responses, and provide insights into their competencies and fit for the role. This ensures a fair and objective evaluation process.

One of the significant advantages of using AI in hiring is its potential to reduce bias. AI algorithms focus solely on candidate’s qualifications and skills, eliminating unconscious biases that may influence human recruiters. This promotes diversity and inclusion within the insurance industry, ensuring that hiring decisions are based on merit. However, it is crucial to continuously monitor and refine AI algorithms to prevent any inadvertent biases from being introduced.

By embracing AI-driven solutions, insurers can streamline their HR, hiring, and recruitment processes, ultimately leading to a more efficient and effective talent acquisition strategy. The rise of AI in the insurance industry is not only transforming traditional operations but also revolutionising how insurers attract, assess, and manage talent, ensuring they stay competitive in a rapidly evolving market.

Digital Transformation and Its Implications in the Insurance Industry

The insurance industry is undergoing a profound digital transformation, driven by technological advancements that are reshaping every aspect of the business. This transformation extends to Human Resources (HR), hiring, and talent management, fundamentally altering how insurers attract, recruit, and retain talent. This section delves into the implications of digital transformation on HR practices in the insurance industry.

Impact on HR Processes

The digital transformation is revolutionising HR processes in the insurance industry. Advanced technologies such as AI, big data, and cloud computing are enabling HR departments to automate routine tasks, streamline workflows, and enhance decision-making. These innovations lead to more efficient HR operations, allowing HR professionals to focus on strategic initiatives rather than administrative tasks.

Enhanced Recruitment Strategies

The adoption of digital tools and platforms is transforming recruitment strategies in the insurance industry. AI-driven applicant tracking systems (ATS) and recruitment software are automating the initial stages of hiring, from resume screening to interview scheduling. These tools can quickly analyse candidate profiles, match them with job requirements, and rank them based on suitability, ensuring that the best candidates are identified and engaged promptly. Additionally, digital platforms facilitate remote interviews and virtual assessments, making the hiring process more flexible and accessible.

Improving Candidate Experience

Digital transformation is significantly enhancing the candidate experience in the insurance industry. AI-powered chatbots and virtual assistants provide instant support to candidates, answering their queries and guiding them through the application process. These tools ensure 24/7 availability and quick response times, creating a seamless and positive experience for job seekers. Moreover, personalised communication through digital platforms helps in building stronger relationships with candidates, increasing their engagement and interest in the company.

Data-Driven Talent Management

The use of big data and analytics is transforming talent management in the insurance industry. HR departments are leveraging data to gain insights into employee performance, satisfaction, and development needs. Predictive analytics can forecast future hiring requirements, identify skill gaps, and recommend targeted training programs. This data-driven approach allows for more informed decision-making, ensuring that the right talent is in place to meet organisational goals. Additionally, analytics can help identify high-potential employees and create personalised career development plans to retain top talent.

Enhanced Employee Onboarding

Digital transformation is streamlining the onboarding process for new hires in the insurance industry. Digital onboarding platforms provide a centralised hub for all necessary documentation, training materials, and orientation schedules. This not only simplifies the onboarding process but also ensures that new employees have access to all the resources they need to succeed in their roles from day one. Virtual onboarding sessions and e-learning modules offer flexibility and convenience, accommodating remote and hybrid work environments.

Boosting Employee Engagement and Retention

Digital tools are playing a crucial role in boosting employee engagement and retention within the insurance industry. Internal communication platforms, employee recognition programs, and feedback tools are enhancing the overall employee experience. By fostering a culture of continuous feedback and recognition, insurers can improve employee morale and job satisfaction. Additionally, digital transformation enables HR departments to implement personalised engagement strategies, catering to the diverse needs and preferences of their workforce.

By embracing digital transformation in HR, hiring, and talent management, insurers can stay competitive and meet the evolving demands of the digital age. The adoption of AI, big data, and advanced digital tools is essential for enhancing recruitment strategies, improving candidate experiences, and driving data-driven talent management practices in the insurance industry

Impact on HR and TA Strategies

- Growing Need for AI and Data Analytics Talent

In today’s digital age, the insurance industry faces an increasing demand for professionals with expertise in AI and data analytics. These specialists play a critical role in harnessing data-driven insights to enhance decision-making processes, streamline operations, and provide personalised customer experiences. Companies must invest in attracting and retaining such talent to stay competitive. - Upskilling and Reskilling Existing Employees for Future Readiness

To keep pace with technological advancements and industry shifts, insurance companies must prioritise upskilling and reskilling their workforce. Providing continuous training programs helps employees adapt to new tools and methodologies, ensuring they remain valuable assets to the organisation. This approach not only enhances employee satisfaction and retention but also boosts overall productivity and innovation. - Cultivating a Culture of Continuous Learning and Innovation

Developing a culture that embraces continuous learning and innovation is essential for long-term success. Encouraging employees to engage in lifelong learning and stay updated with industry trends fosters an environment where new ideas and creative solutions are nurtured. This proactive stance on learning helps companies stay ahead of competitors and drive sustainable growth. - Implementing Ethical Training for Responsible AI Use

The integration of AI in HR and talent acquisition introduces ethical considerations that must be addressed. Providing ethical training for employees ensures that AI technologies are used responsibly, aligning with the company’s values and societal expectations. This commitment to ethical AI use builds trust with stakeholders and safeguards the company’s reputation.

Aligning Recruitment Efforts with Strategic Business Needs

- Enhancing Employer Branding to Attract Top Talent

A robust employer brand is crucial for attracting and retaining top talent in the insurance industry. Companies should highlight their values, workplace culture, and career development opportunities to differentiate themselves from competitors. Effective employer branding strategies can significantly boost the company’s appeal to prospective employees, helping to secure the best candidates. - Leveraging Technology to Streamline Hiring Processes

The adoption of advanced HR technologies can greatly enhance the efficiency and effectiveness of recruitment and hiring processes. Tools such as AI-driven recruitment platforms, applicant tracking systems, and employee management software streamline operations, reduce administrative burdens, and improve the candidate experience. By leveraging these technologies, companies can make more informed hiring decisions and optimise talent management.TurboHire is transforming talent acquisition in the insurance industry, particularly as the sector adapts to the digital age. As the industry shifts towards more tech-driven solutions, the demand for specialized talent in insurance technology is increasing. Traditional hiring strategies are being adapted to meet these new demands, highlighting the need for efficient and effective talent acquisition tools.TurboHire improves the recruitment process through its comprehensive platform, offering a seamless candidate experience with real-time feedback to ensure engagement and positivity. For recruiters, it utilizes AI-powered tools to efficiently screen and match candidates to suitable roles, significantly reducing time-to-hire and enhancing the quality of hires. Interviewers benefit from scheduling tools and structured guides, enabling consistent and effective evaluations. The platform also supports approvers with multi-channel, multi-device job requisitions and approvals, ensuring compliance with budget and organizational guidelines. Additionally, leadership benefits from real-time data provided through actionable alerts and dashboards, which aid in making informed decisions to enhance overall business operations.Further demonstrating its utility, TurboHire integrates seamlessly with major HRMS and WFM platforms like SAP SuccessFactors, Workday, Oracle HCM, and others. This compatibility ensures that insurance organizations can elevate their hiring processes to meet the expectations of a future-focused workforce across various sectors.

- Fostering a Culture of Innovation and Continuous Improvement

Promoting a workplace culture that values innovation and continuous improvement is key to maintaining a competitive edge. Encouraging employees to pursue innovative solutions and regularly refine processes leads to ongoing enhancements in performance and efficiency. This culture of continuous improvement drives the company towards achieving its strategic goals and adapting to industry changes.The insurance industry must evolve its HR and talent acquisition strategies to meet the challenges of a rapidly changing landscape. By focusing on attracting AI and data analytics talent, upskilling the workforce, fostering a culture of continuous learning, ensuring ethical AI use, and aligning recruitment with strategic business needs, insurance companies can build a resilient and innovative workforce. Embracing these strategies will enable insurance firms to thrive in the digital era, delivering superior value to both employees and customers.

Future Trends: AI in the Insurance Industry & HR’s Evolving Role

The insurance industry is undergoing a significant transformation, driven by artificial intelligence (AI). AI technologies are being leveraged to enhance various aspects of the industry, from underwriting and claims processing to customer service and fraud detection. Insurers are using machine learning algorithms to analyse vast amounts of data, enabling more accurate risk assessments and personalised policy recommendations. This shift towards AI-driven processes not only improves efficiency but also enhances customer satisfaction by providing faster and more tailored services.

AI is revolutionising the customer experience in the insurance sector. Chatbots and virtual assistants powered by AI provide instant support and assistance, answering queries, processing claims, and offering policy recommendations. These AI-driven tools ensure customers receive prompt and accurate responses, enhancing their overall experience. Additionally, AI helps in personalising interactions, making customers feel valued and understood.

HR’s Evolving Role in the Age of AI

- Strategic Workforce Planning

As AI continues to reshape the insurance industry, HR professionals are playing a crucial role in strategic workforce planning. They are tasked with identifying the skills and competencies needed to thrive in an AI-driven environment. This involves assessing current talent, identifying skill gaps, and developing strategies to attract, retain, and develop employees with the necessary expertise. HR must also anticipate future workforce needs and align talent strategies with the organisation’s long-term goals. - Emphasis on Continuous Learning and Development

The rapid pace of technological advancements necessitates a focus on continuous learning and development. HR departments are responsible for creating and implementing training programs that keep employees updated on the latest AI technologies and methodologies. This commitment to ongoing education ensures that the workforce remains agile and capable of leveraging AI tools effectively. By fostering a culture of continuous learning, HR helps employees adapt to change and drive innovation. - Ethical Considerations and Responsible AI Use

With the increasing use of AI, ethical considerations are becoming more prominent. HR plays a vital role in ensuring that AI technologies are used responsibly and ethically within the organisation. This includes developing and enforcing policies that address bias, privacy, and transparency in AI applications. HR must also provide training on the ethical use of AI, ensuring that employees understand the implications and responsibilities associated with these technologies. - Enhancing Employee Experience through AI

Just as AI improves the customer experience, it also enhances the employee experience. HR departments are leveraging AI to streamline HR processes, such as recruitment, onboarding, and performance management. AI-powered tools can automate administrative tasks, provide personalised career development recommendations, and offer insights into employee engagement and satisfaction. By utilising AI in HR processes, companies can create a more efficient and supportive work environment.The future of the insurance industry is being shaped by the integration of AI technologies, which are transforming processes and enhancing customer experiences. As AI continues to evolve, HR’s role is also changing, becoming more strategic and focused on continuous learning, ethical considerations, and improving the employee experience. By embracing these digital transformation strategies, insurance companies can build a resilient and innovative workforce that is well-equipped to navigate the challenges and opportunities of the digital age. The synergy between AI in the insurance industry and AI in talent management will drive the sector forward, creating a dynamic and future-ready ecosystem.

Conclusion

The transformative impact of AI on the insurance industry is undeniable. AI technologies are revolutionising processes, from underwriting and claims processing to customer service and fraud detection. These advancements have necessitated significant organisational changes, emphasising the importance of digital transformation strategies for staying competitive. The integration of AI and data analytics has become a cornerstone for insurers, enabling them to deliver more accurate risk assessments, personalised policies, and enhanced customer experiences.

Equally important is the evolving role of HR and Talent Acquisition (TA) strategies in navigating these changes. HR professionals are at the forefront of strategic workforce planning, ensuring that companies attract, retain, and develop the talent necessary to thrive in an AI-driven environment. The emphasis on continuous learning and development is crucial for keeping the workforce agile and capable of leveraging AI tools effectively. Additionally, ethical considerations in AI use are paramount, with HR playing a critical role in ensuring responsible and transparent AI implementation.

Looking ahead, insurance companies must prepare for future trends and challenges by embracing digital transformation and AI technologies. This preparation involves a commitment to continuous learning, fostering a culture of innovation, and aligning recruitment efforts with strategic business needs. By doing so, insurers can build a resilient and innovative workforce that is well-equipped to navigate the rapidly changing landscape.

In summary, the future of the insurance industry lies in the successful integration of AI and the strategic evolution of HR practices. By adopting these digital transformation strategies, insurance companies can ensure they remain competitive, deliver superior value to customers, and create a dynamic, future-ready ecosystem. The synergy between AI in the insurance industry and AI in talent management will drive the sector forward, enabling it to meet the challenges and opportunities of the digital age.